DELAYS in the payment of thousands of invoices by council authorities across Northern Ireland are “causing real problems for businesses” with more than 20% outstanding after 30 calendar days.

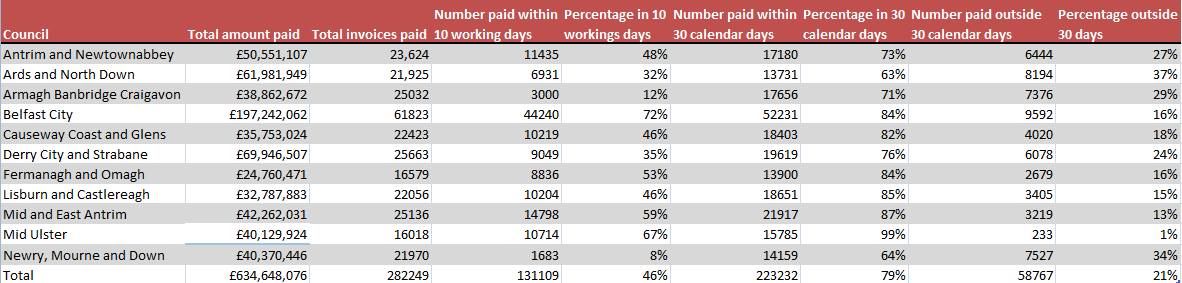

Detail Data analysed the length of time it took the 11 local government councils to pay 282,249 invoices worth nearly £635 million during the 2015/16 financial year.

The Stormont Executive’s Prompt Payment Policy recommends that government departments should, “aim to pay 90% of valid invoices within 10 working days”, with councils encouraged to match that.

Despite this, Detail Data analysis of the performance of councils showed that just 46% of invoices were being paid in this timeframe. Performance ranged from 72% of invoices paid in 10 working days in Belfast City to 8% in Newry, Mourne and Down.

Adherence to the 10 day policy is not mandatory for councils, but in a letter issued to council chief executives in October 2013, the Department of Environment’s Local Government Policy Division said that: “District councils are encouraged to pay suppliers as promptly as possible and to endeavour to meet the 10 day prompt payment commitment made by Northern Ireland Executive in response to the current economic position.

“The aim of the policy is to speed up cash flow from the public sector to its suppliers, particularly SMEs (small and medium enterprises).”

Northern Ireland Local Government Association (NILGA), the representative body of the 11 councils, told Detail Data it is endorsing a “focused performance management and improvement system” to improve performance on an issue which it acknowledges has a significant impact on businesses and suppliers.

Click on the table to enlarge it.

To view all the data from this article click here.

Although mechanisms exist that could see councils penalised for failing to pay valid invoices within 30 working days, the Federation of Small Businesses (FSB) has said that members are reluctant to challenge councils on the matter because “most are concerned about being considered to be difficult to work with”.

Councils are required to provide details of their invoice payment performance to the Department for Communities (formerly Department of Environment) on a quarterly basis.

According to the department, councils who fail to pay valid invoices within 30 days are potentially liable to pay interest and compensation.

“District councils are autonomous bodies encouraged to pay suppliers as promptly as possible and to endeavour to meet the 10 day prompt payment commitment made by the NI Executive,” a DfC spokesperson said.

“All public authorities are required to pay suppliers within 30 calendar days of receipt on an undisputed invoice. Public sector organisations are bound by the Late Payment of Commercial Debts (Interest Act) 1988 as amended by various legislation including Late Payment of Commercial Debt Regulations 2013 (SI 395).

“This legislation requires that public sector organisations aim to ensure that in commercial transactions, the payment period does not exceed 30 calendar days after the debtor receives an invoice.

“Under the Late Payment of Commercial Debt Regulations 2013, compensation arising out of late payment can be sought, with the supplier entitled to a fixed sum (in addition to the statutory interest on the debt). This is not compulsory and is for the supplier to decide whether or not to use the rights made available to it.”

Despite this, figures for the 2015/16 financial year showed that while Mid Ulster Council paid 99% of invoices within 30 days, others (Newry, Mourne & Down, North Down and Ards) paid less than 40%.

Across all 11 councils, 21% of invoices were not paid within 30 days.

According to at John Friel the NI Regional Chair of the Federation of Small Businesses (FSB), delays in payment by councils are placing a huge strain on local business.

“By failing to pay their suppliers promptly, small businesses, who can ill-afford to do so, are providing interest free credit to councils, who frankly don’t need it,” she said.

“Northern Ireland is a very small place, and most businesses are keen to just get on with their work without drawing attention to themselves. Most are too concerned not to be considered to be difficult to work with to actually raise formal complaints.”

A sole trader, who asked to remain anonymous, said his business had to wait more than two months for payment from one council.

“If you are a newly established sole-trader you need your invoices paid promptly just to take on other work,” he said.

“Quite often you won’t get a credit line from your own suppliers so you have to pay them up front. That can run in to thousands. Then by the time you get paid by the councils that can be up to 60 days.

“As a result you don’t have a buffer that would allow you to take on other work. You do eventually get paid but you have no cash flow so you could have to turn down other work because you wouldn’t be able to pay your suppliers up front.

“When you ask the councils why it is taking them so long they say it is because of a lack of staff, but they should have automated systems for dealing with this.”

In acknowledging that there is a significant issue relating to delays in payment to suppliers by some councils, the Northern Ireland Local Government Association (NILGA) said that following the completion of the Review of Public Administration (RPA) which reduced the number of councils from 26 to 11, it was proposing measures to improve performance.

“Concerns regarding the prompt payment by councils of invoices continue to be a challenge post RPA,” a NILGA statement said.

“While the standard of performance varies across the 11 council areas, the Association recognises that the impact of delayed payments can be significant to businesses and suppliers. In recognition of this, within NILGA’s Programme for Local Government (which will be published on June 24), we have committed to working with central and local government on a number of specific asks including a shared, cross-governmental, focused performance management and improvement system.”

THE DATA

Prompt payment performance is measured against three criteria – payment within 10 working days, payment within 30 calendar days and payment in more than 30 calendar days.

Performance on all three measures, recorded by the Department for Communities, differs dramatically between the 11 councils.

For example, in 2015/16 Belfast City paid 72% of its 61,823 invoices within 10 working days. This compares to Newry, Mourne & Down paying just 8% of their 21,970 invoices within this timeframe.

Mid Ulster was the best performing council over the 30 calendar day measure – with 99% of their 16,018 invoices paid in 2015/16. By comparison Ards & North Down paid just 63% of 21,925 within 30 days. Newry, Mourne & Down again performed poorly – paying just 64% by 30 days.

In 2012/13 councils paid 40% of invoices within 10 working days and 81% within 30 calendar days.

In her 2015 report, local government auditor Louise Mason stated: “It is my opinion that they (the 11 new councils) should strive to build on the improvements of the old (26) councils and aim to match the performance of central government.”

Analysis of figures from the auditor’s previous reports shows that although 10 day performance improved from 37% in 2012/13 to 46% in 2015/16, 30 days performance has fallen from 81% in 2012/13 to 79% in 2015/16.

TACKLING THE PROBLEM

In a newly compiled report also published today, FSB make four recommendations that it believes would alleviate the problem.

- The Department for Communities should introduce additional reporting requirements including: number of invoices received; value of invoices received and number of invoices disputed.

- The NI Local Government Auditor should place greater emphasis on the performance of councils in paying suppliers, making recommendations for improvement.

- The Department for Communities should request that all councils publish their performance data on their own websites.

- All councils to review internal payment processing systems and include recommendations for improvement.

To view the FSB report click here.

By

By